I’m pretty excited about seeing where we finished up in Year Two, and I will be comparing each category to Year One as we go along along with some fancy charts and graphs. (Happy Birthday Bill!!) One of the things we tried in Year 2 was to have more categories and this was with mixed results. We did a pretty lousy job of delineating costs in some categories (groceries expendables versus consumables comes to mind) and in others it’s so subjective what category we place things in, I am not sure it really provides any value. Lee and I will be reviewing the categories right after this post is done and you will start seeing the changes in January. Since we now have 24 data points, we will hopefully be more confident in adjustments to our budget numbers. In some cases we pick a number and even if we go over consistently we stick with it to try to hold ourselves accountable, but in other categories it becomes clear over time that adjustments are called for. Then there are the standard cost of living increases (such as higher insurance rates) and those we adjust as the rates increase.

So how did we do? We were amazingly close in our Actuals versus Budget with a deficit of only $1076!!! Some individual categories have large variances, but the totals worked out nicely. We actually spent a little bit more this year than last year with $51,927 in expenses versus $49,410 last year, but before you get concerned about the fact that we spent more this year than last year, keep in mind Alaska. That trip obviously had a pretty dramatic impact on this years numbers. (And obviously we spent way more than the $2500 difference between the two years while we were in AK, so that shows that this year’s “actual” numbers were really much better than last year. I credit me, naturally. – Lee)

Fair warning for those of you who find all the detail a little boring, you probably want to stop here. I’ll been promising Lee a trend analysis once I got enough data points, so the rest of this post is going to go into some very specific detail. That was harder than it sounds, mainly because we changed categories after last year so in order to complete a year over year comparison I had to do some consolidation. Thus it’s not a perfect year over year comparison, but certainly close enough for our purposes. I know Bill will enjoy it, but many people might find it a little boring. No worries if you fall into that category, I promise it won’t hurt my feelings. (This one’s for you, Bill. – Lee)

For those still with me, let’s start with a picture of the detailed break down for this year.

And a chart showing year over year comparison. Again keep in mind it’s not perfect because I had to combine some categories.

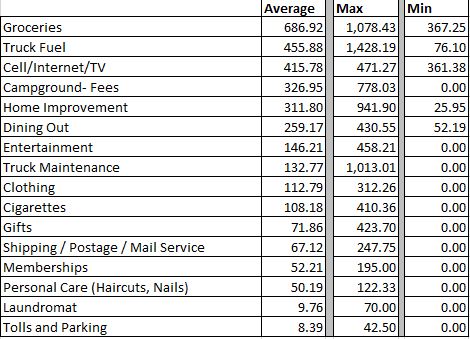

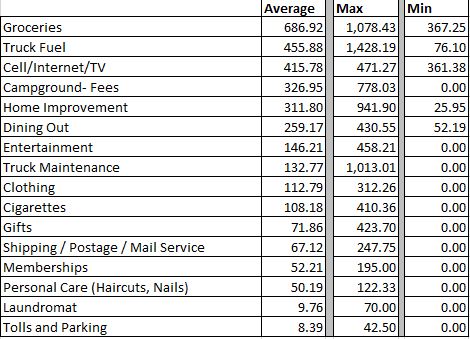

Plus the Averages, Monthly Maximum and Monthly Minimum over the two year period, keeping in mind I had to combine some categories to try and make an apples to apples comparison.

Finally a pie graph with the 2015/2016 totals for larger expenditures. I didn’t include health insurance, because I had corporate insurance all of 2015 and part of 2016. (A pie chart! We’re such nerds! – Lee)

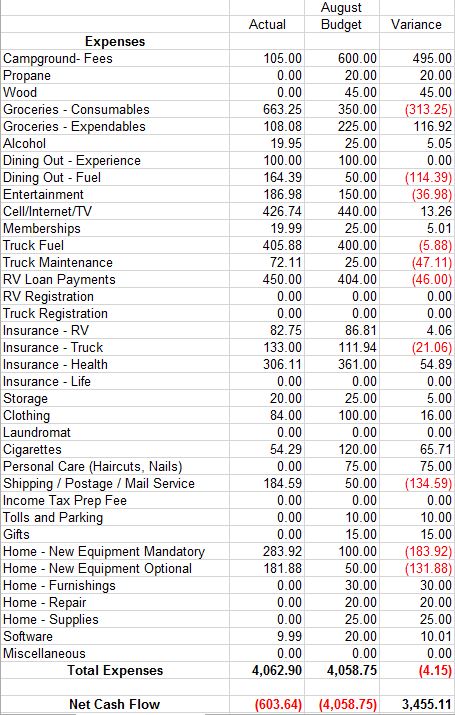

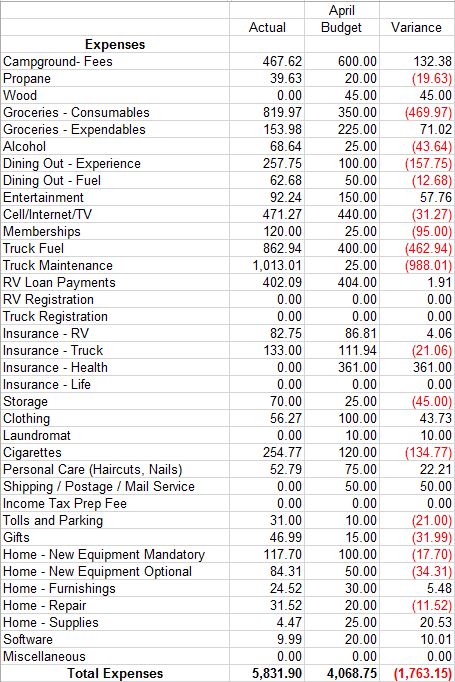

Still with me? Alright let’s talk about each category in order of 2016 spend amount.

Groceries – We were over budget in 2015 and saw minimal improvement in 2016 despite increasing our focus. We like food and I like cooking meals. The only time we ever see a reduction in a month is when we eat out more than we should, which obviously is not a great way to get a budget category under control. $8,250 in food costs is rough, but so far we are unwilling to make the changes we would need to make to get these costs lower. At least we are consistent, lol. (And I think our waistlines clearly show a visual representation of our dedication to this. – Lee) Our two year average was $687 with a high of $1078 and a low of $367. The extremes were caused by being in areas with high food costs (Alaska and Glacier were the worst) but even taking that into account on average we are almost $100 over budget per month. Obviously this is more than two people need to eat every month and where we struggle is that more than any other budget area when we cut back we feel “poor.” That’s a tough mental obstacle for us to overcome and the budget numbers show it.

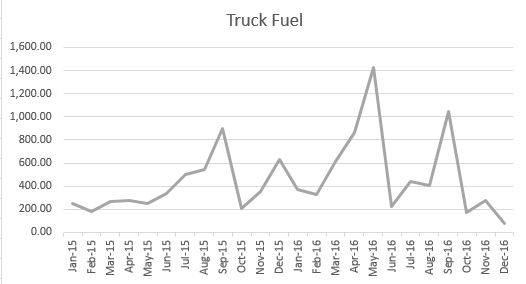

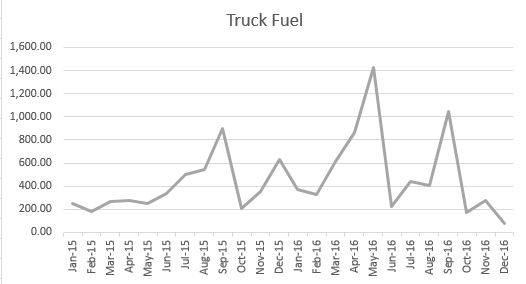

Truck Fuel – Not surprisingly we went up in this category with $6250 in spend this year. Considering we spent at least $1500 in gas to get to Alaska and back, and more gas than usual while we were there, it wasn’t so bad. I also didn’t have a company car, like I did in most of 2015, so we used the truck for all our traveling. If you take those factors out of the equation we actually did better than last year, partly due to the extremely low fuel costs in 2016. Our average was $456 which is only $50 over budget and I think we did great coming so close if you consider all the miles we traveled in the last two years.

Cell/Internet/TV – We spent more than $5200 in this category so it deserves some explanation. We took advantage of a double data deal back when we first started and we have 80 gig of data. This data level might seem high, but it is for our internet use and our TV solution. Some of that money is tax deductible because we use it for our businesses, but it’s still a chunk of money. We also have a separate Verizon phone (I used my company phone for most of 2015) with a tiny little data plan which we use when we don’t have ATT coverage. Since we rarely go without ATT coverage I did look and see if adding a second line to ATT and ditching the Verizon coverage might help, but it doesn’t seem that much cheaper. We have had numerous discussions about going with a cheaper, less reliable option, but that’s a tough sell for us. I continue to hold out hope that pressure from the Milennial generation ultimately results in reasonably priced data for mobile workers. In the meantime we are sticking with the devil we know.

RV Loan Payments – We knew when we chose to sell our house for less than it was worth we would have an RV payment adding up to $4847 a year. Two years later I still don’t regret that decision at all, since the housing situation in Keene is no different now than it was then. They actually went through this year and lowered the housing values for tax purposes so if we had held out for perceived equity we might still be sitting there. $404 a month (interest tax deductible) is a small price to pay.

Health Insurance – Our costs in 2016 ran roughly $4228 and that’s about what we think they will run in 2017. It’s an estimate though because we really don’t know what we will make this year. Costs may come in higher or lower. Despite the cost, this is not an area I am willing to experiment with at this time. Plus I am overdue for a mammogram, pap smear, and colonoscopy, so if I find a way to get those tests done in 2017 the annual cost will more than make up for that. The biggest challenge for us will be finding a place where we can get all that done.

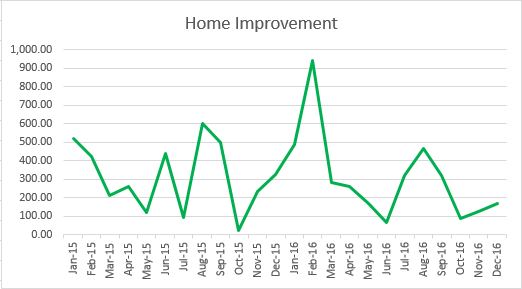

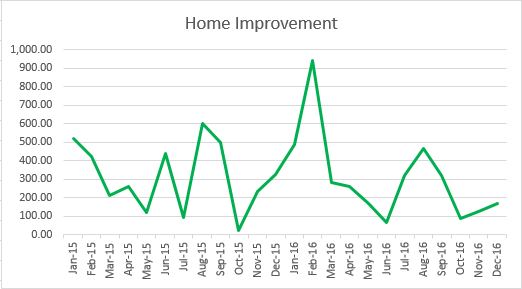

Home Improvement – Despite intense focus on this category we ended up almost the same at $3714. Tracking these costs in more detail did help though, because we definitely spent more this year on necessary purchases than supplemental. We had several unexpected repairs and those coupled with one time expenses to get setup for long-term boondocking in Quartzsite accounted for $2211 in spend. Two years in I don’t see this category ever going down much (although Lee continues to be hopeful), we ended 2016 with a repair and started 2017 with another and we had some sort of repair almost every month in 2016. At this point it seems to be a natural cost of the lifestyle. Our monthly average is $311 which is close to $100 more than we want to spend a month. As you can see from the $942 maximum though that one or two major repairs can really blow the yearly average, regardless of how well you do the other months.

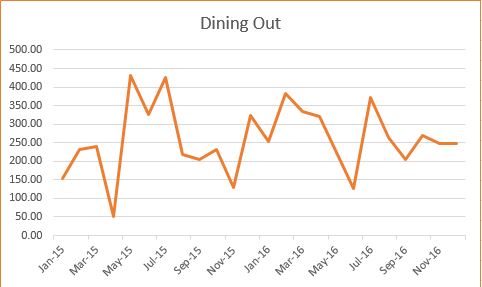

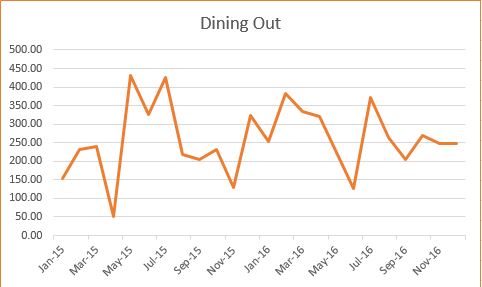

Dining Out – I don’t know that dividing this into two categories ended up making that much of a difference. We spent $281 more in 2016 than in 2015 for a total of $3251 and since our budget was only $1800 we went over by $1450. That’s just not OK and it’s definitely residual from our old life. I love to eat in local places for the experience and Lee loves to eat well. (You don’t get a physique like mine from diet and exercise, baby. – Lee) That combination does not serve us well. If it was just Lee he probably wouldn’t go and if it was just me I could get by on water and an appetizer. Honestly I don’t know how to solve the problem other than just stop going, but that makes me sad because part of exploring a new place is sampling the local restaurants. We do need to figure this one out though, because $1,500 is not an insignificant amount of money in this lifestyle. Our average is $259 around $100 over budget (I am seeing a pattern here) and we stay pretty consistent here month over month with the occasional highs and lows. In this case though the average absolutely reflects our normal monthly spend.

Truck/RV Insurance and Registration – Combined these totaled $2769 and the truck insurance at least has been well worth it. We got a windshield replaced and of course had a brand new truck engine in 2015. We have never used our RV insurance, but at this point are not willing to give it up. It is essentially our homeowners insurance and covers our RV and the stuff in it. Since almost all of our worldly possession are in this rig, that’s a big deal. Also after having seen pictures of two rigs that burnt to the ground last year, this is not something we personally are willing to go without.

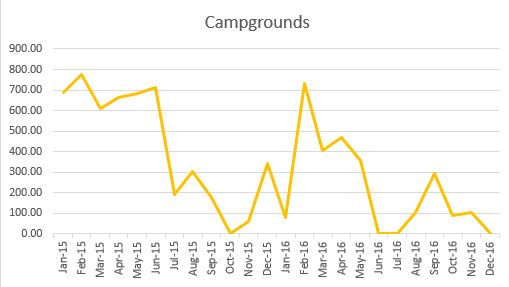

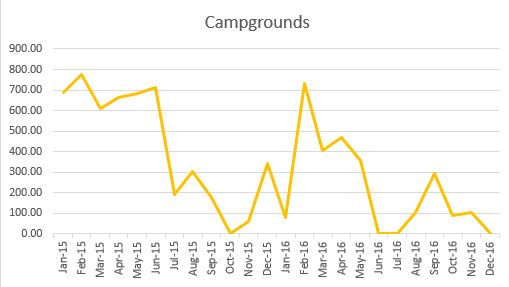

Campground Fees – We only spent $2,633 this year which was a huge improvement from last year. We have been under budget in this category for both years and it has been a huge budget saver. Partly this is because of work kamping, but also it is because we invested in solar and a generator and can boondock. We could do even better in this category, but we tend to choose expediency over cost when we are traveling. The most we ever spent was $778 and those high costs were all when we first started. This is one area where we have seen a nice downward trend over time, which is encouraging.

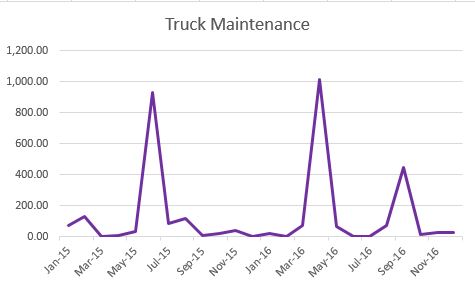

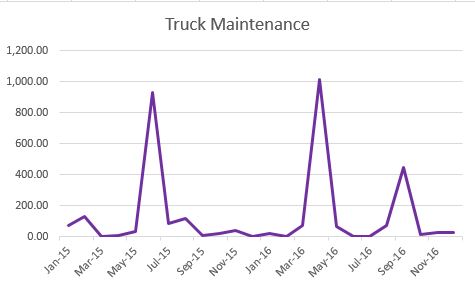

Truck Maintenance – We got whacked in this category, despite having two excellent warranties, spending $1755 on new tires and an alignment. Both of those purchases were absolutely necessary because of our Alaska trip, but it definitely wasn’t something either of us originally expected. I had hoped this category would “normalize” in 2017, but as I was writing this post we took our truck in for it’s 60K maintenance and were told both front tires needed to be replaced. The quote for that along with the alignment is $555. This category like RV maintenance appears to be the cost of doing living the RV lifestyle. This is another category where a few high ticket expenses can really impact your annual budget.

Entertainment – We did great in this category spending $1,736 and ending up $64 under budget for the year and $289 less than 2015. It’s particularly impressive because it not only includes outings but also music and book purchases. We stayed on budget by focusing on Activities under $10 . We did splurge occasionally but generally every month we are under budget in this category. That shows a real shift in focus versus our old lives and I wish we could emulate this trend in other categories. This was probably our most consistent category with the two year average at $146 right below our monthly targets. We had a couple of high months but those were offset by very low months and it worked out very well in the end.

Clothing – We focused on this category and actually did pretty well in it considering we had to buy clothes for the beet harvest. We spent $1305 for the year and this includes T-Shirts (which shows remarkable restraint for us) and normal replacement clothes. We were within $100 of our budget which is something we can live with.

Cigarettes – At $1260 for the year we were both under budget and under last years costs. Lee has taken the state by state cost variation out of the equation by buying in bulk through the mail. This was something that was not available in 2015, and really helped us keep those costs normal during our time in Alaska. We actually took in enough tobacco to last for two months and then received the rest that we needed in the mail. This was a major budget saver as tobacco (like everything else) was extremely expensive in Alaska. And yes, obviously this is an optional cost, but as compared to the $6700 a year we were spending a year in our old lives this is a huge improvement.

Shipping/Postage/Mail Service – Despite intense focus this year we were actually a little over last years number at $815. Most of this though can be attributed once again to Alaska. We shipped some presents home, which are in the category and got whacked a couple of times with very high shipping fees to get our mail to us. Lee continues to make this a priority though and if you take Alaska out of it, I definitely think we are seeing improvement.

Memberships – Spending over $700 a year in this category may seem steep, but we have the America the Beautiful Pass, Escapees Membership, Passport America, Costco, Work Kamper News, and an American Express Gold Card. We have done the cost analysis on all of them and they all saved us more money than they cost or provide sufficient value that we retain them. We continue to evaluate these every year though. The credit card in particular we have discussed changing, and could probably do better with multiple cards used based on what pays the most points, but we really like the company and their fraud protection.

Gifts – In more than any category we saw YOY improvement with only $669 in 2016 purchases versus $1066 in 2015. Essentially I adjusted my gift giving to match our income. I really thought it would have been harder to make this adjustment emotionally, but it turned out it was pretty easy. Plus the fact that almost everyone I know makes more than me at this point really helped 🙂

Storage – We reduced our spend in this category to $540 this year by asking the kids to pay their share. We both really want to go back and clean this storage area out, but New Hampshire is in the opposite direction where we want to be so this is easier said than done. Also I think its worth mentioning that although I can’t remember much about what is in there, a few items do stick out and we want to hang onto those. Lee’s parents offered storage space in their basement and we will definitely take them up on that for the remaining items.

Personal Care – We also saw great YOY improvement in this category spending $448 which was $307 less than last year! How did we do it? We both extended the time between hair cuts (pretty easy when the closest hair cut place in Alaska was a couple hours away) and I eliminated most of my extra beauty expenditures. I still had my eyebrows waxed a few times and I think 2 pedicures, but those events were few and far between. It’s probably not surpising that I never care about that stuff when we are surrounded by nature. I only start thinking about it when we are in an urban environment.

Propane – We included propane costs in campground fees for most of 2015 but this year we separated it out and only spent $225. The more you boondock the more you spend in propane, but you can also rack up propane costs if you don’t have an adequate electric heat source. Lee spent some time putting in extra outlets so we can run three heat sources simultaneously (as long as we are on 50amp) so we never have to use our propane furnace unless we are boondocking. (Technically if we are at a site that has 30 and 15 amp, which is pretty common, we can still run all three. Not much more, but it keeps us warm and snuggly. – Lee) This saves us quite a bit in propane costs and takes full advantage of any hookups we may have.

Alcohol – We didn’t separate this out last year so I have no idea how we compared but we only spent $181 which I think is very reasonable. Our drinking patterns are odd, because we only drink when we are with other people that drink, but then we tend to buy lots of alcohol. I do recommend tracking this category though if you are a frequent drinker. Those costs can really add up.

Laundromat – We spent $164.25 at the laundrymat this year and most of that was while we were in Quartzsite. We use our Splendide 2100 almost exclusively (with the occasional exception of sheets and blankets) except when we are boondocking. The more boondocking, the higher the laundry costs. Our camp host job in Alaska also had the extra benefit of a full washer and dryer which saved us any laundry fees throughout the summer.

almost exclusively (with the occasional exception of sheets and blankets) except when we are boondocking. The more boondocking, the higher the laundry costs. Our camp host job in Alaska also had the extra benefit of a full washer and dryer which saved us any laundry fees throughout the summer.

Wood – This was another category we lumped into campground costs in 2015 and this year we spent very little. We had free wood while camp hosting in Susanville, the Redwoods, and Alaska and lived in “no fire” areas during the Beet Harvest and Christmas trees. We were going to buy wood for Quartzsite in 2016, but are waiting until we are 100% sure that is where we will be. We talked about propane campfires, but I just don’t care for them, so we will continue to buy wood whenever it makes sense. Free wood is always a nice perk though, and we have taken advantage of it when we are given it. So we only spent $20 but we also filled up with wood at the end of 2015 and will buy wood again at the beginning of 2017. We also intentionally ran out of wood early in 2016 because we knew we would have to cross the Canadian border and we couldn’t take it with us. So really half the year we were abnormally “wood free” in our truck.

If you have made it this far, and good for you by the way, you might think this is all pretty hopeless. That’s how I felt when I looked at other people’s budgets before full timing, but let me tell you what the numbers don’t say. First, there were lots of expenses in year one I just didn’t report on. One time discretionary purchase and health insurance costs never made it to that first year, so even though it looks like we spent the same amount of money we really didn’t. Year two is more representative of our true costs, although I still am not including our business expenses in this reporting.

Secondly, more than anytime in our lives we have choice. We also have a much better understanding of exactly what we spend and why, and with the exception of repairs and the RV loan we have the ability to impact the costs. We could in almost every other category reduce those costs. We chose not to. And that’s a big deal because it means we can choose to do something different in 2017. I am not saying we necessarily will, but we can and I rarely felt that was an option in my previous life.

At this point we have three choices to make this lifestyle sustainable for us. We can spend less, work more, or get jobs that pay more. Pretty simple, and we get to decide. And every single person I know who is living this lifestyle is going through the same thing. Even the people who on the surface are making plenty of money, are looking to the future and making those choices. And that’s a good thing, an important thing.

It’s easy to look at the total dollar amount and dismiss the lifestyle as impossible. I certainly was guilty of that early on in my research, but I am hoping that if you are a person who made it this far you are also a person who can see beyond the high level. And please keep in mind that despite the cost, we paid our bills. We didn’t dip into our savings and actually managed despite the Alaska trip to break even. That is no small thing. Is the lifestyle sustainable for us? I still don’t know, but I firmly believe it could be. We get to decide if it’s worth it to us. Either way we still have our savings, we still have our contingency fund, and we even had 2016 tax money set aside. That is no small thing considering all we managed to do in 2016 and a success story in my opinion.

Supporting our Blog

We very much appreciate your support of our blog.

- As an Amazon Associate I earn from qualifying purchases. Search Amazon Here

- You can purchase the ebook telling the story of how we became full-time RVers.

- You can purchase our recipe book filled with 80 recipes we have cooked in our RV and taste tested by Lee himself. You can purchase the kindle or paperback version on Amazon or buy the Apple version on Itunes.